SAMHI Hotels Acquires 70% Stake in RARE India for Rs 47.39 Crore in Strategic Hospitality Move

SAMHI Hotels Acquires 70% Stake in RARE India for Rs 47.39 Crore in Strategic Hospitality Move KPI Green Energy Executes BESPA for 445 MW/890 MWh BESS Projects

KPI Green Energy Executes BESPA for 445 MW/890 MWh BESS Projects RailTel Secures Rs 26.73 Crore OFC Network Order from South East Central Railway

RailTel Secures Rs 26.73 Crore OFC Network Order from South East Central Railway P N Gadgil Jewellers Ltd opens new FOCO store at Navi Mumbai

P N Gadgil Jewellers Ltd opens new FOCO store at Navi Mumbai Kabra Drugs Limited rebrands as Aanjaay Industries, to enter into JV with Indonesian firm

Kabra Drugs Limited rebrands as Aanjaay Industries, to enter into JV with Indonesian firm

Stock Report

Capital Small Finance Bank Limited - Q4 FY2024 Business Update

Posted On : 2024-04-07 15:09:11( TIMEZONE : IST )

Key Business Highlights for the Quarter and Year ended March 31, 2024:

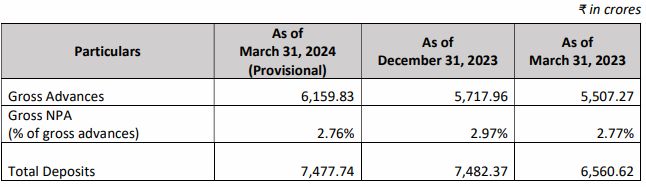

Loan Portfolio: The gross advances of the Bank aggregated to ₹6,159.83 crores as of March 31, 2024, with a secured portfolio of more than 99%. The advances have grown by 8% on quarter on quarter basis.

Disbursement: The Bank has disbursed loans amounting to ₹ 675.81 crores during the quarter ending March 31, 2024 with an increase of 76% on quarter on quarter basis.

Asset Quality: The Bank maintained strong asset quality, with Gross NPAs at 2.76% as of March 31, 2024.

Deposit: The total deposits of the Bank aggregated to ₹7,477.74 crores as of March 31, 2024, with a high CASA ratio of 38.28%. The deposits have grown by 14% on year on year basis.

Loan to Deposit Ratio: The average* CD ratio of the Bank for FY24 stood at 79%.

Liquidity: The average* LCR of the Bank for the quarter ended March 31, 2024, stood at 264.05%.

Capital Raise: The Bank's equity shares were listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) on February 14, 2024, following a fresh issue capital raise of ₹450 crores. As of December 31, 2023, the Bank's net worth (Capital + Reserves) was ₹743.35 crores.

*calculated on daily basis

The information with reference to quarter and year ended March 31, 2024 is provisional and subject to an audit by the statutory auditors of the Bank and approval from the Audit Committee and Board of Directors of the Bank.