Cholamandalam Financial Holdings Ltd 9M FY26 consolidated PAT at Rs. 3860 crores

Cholamandalam Financial Holdings Ltd 9M FY26 consolidated PAT at Rs. 3860 crores Strategic Boost to Atmanirbharta in Shipbuilding as GRSE and HSL Sign MoU

Strategic Boost to Atmanirbharta in Shipbuilding as GRSE and HSL Sign MoU India needs nearly 2,000 Exploration Licenses in oil and gas to become energy secured says, Vedanta Group Chairman

India needs nearly 2,000 Exploration Licenses in oil and gas to become energy secured says, Vedanta Group Chairman Nifty steadies after gap-up, recovery attempts gain traction

Nifty steadies after gap-up, recovery attempts gain traction Nifty Rises Sharply on Strong Global Cues, Closes at One-Month High

Nifty Rises Sharply on Strong Global Cues, Closes at One-Month High

Stock Report

ESAF Small Finance Bank Limited - Q4 FY2023-24 Key Business Update

Posted On : 2024-04-07 15:07:01( TIMEZONE : IST )

ESAF Small Finance Bank Limited has announced the business update for the period ended March 31, 2024.

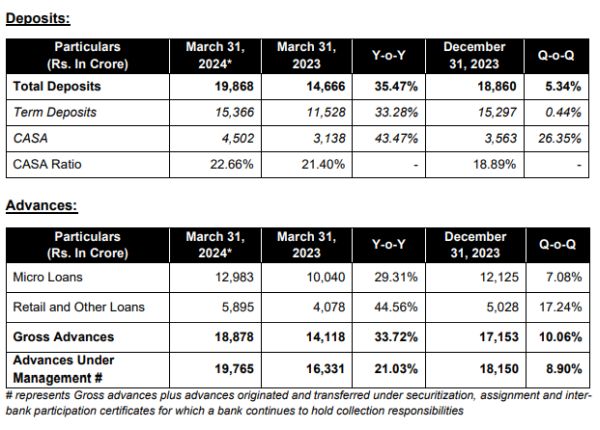

Total deposits grew by 35.47% YoY to reach Rs. 19,868 Crore as on March 31, 2024 compared to Rs. 14,666 Crore as on March 31, 2023. CASA deposits increased by 43.47% YoY to reach Rs. 4,502 Crore as on March 31, 2024 compared to Rs. 3,137 Crore as on March 31, 2023. CASA ratio stood at 22.66% as on March 31, 2024.

Gross advances grew by 33.72% YoY to Rs. 18,878 Crore as on March 31, 2024 as against Rs. 14,118 Crore as on March 31, 2023.

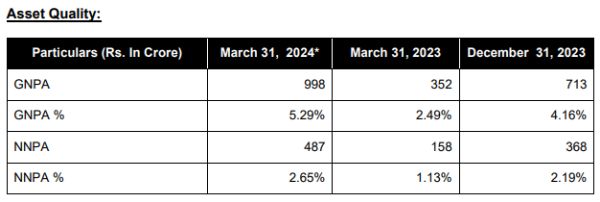

GNPA% and NNPA % as on March 31, 2024 stood at 5.29% and 2.65% respectively.

The Bank's distribution network as on March 31, 2024 stood at 753 branches and 614 ATMs.

We have operationalised the Authorised Dealer Category 1 Licence (Foreign Exchange operations), with effect from April 02, 2024.

*The information with reference to Q4FY24/ YE March 31, 2024 is provisional and subject to an audit by the statutory auditors of the Bank.

Shares of ESAF Small Finance Bank Limited was last trading in BSE at Rs. 63.72 as compared to the previous close of Rs. 62.31. The total number of shares traded during the day was 229593 in over 1474 trades.

The stock hit an intraday high of Rs. 64.44 and intraday low of 62.56. The net turnover during the day was Rs. 14590255.00.