Oracle Financial Services Software Ltd Q3 FY2026 consolidated profit rises to Rs. 609.6 crores

Oracle Financial Services Software Ltd Q3 FY2026 consolidated profit rises to Rs. 609.6 crores Waaree Energies Ltd reports consolidated PAT of Rs. 1062.46 crores in Q3 FY26

Waaree Energies Ltd reports consolidated PAT of Rs. 1062.46 crores in Q3 FY26 Lemon Tree Hotels announces the signing of its new property in Madhya Pradesh

Lemon Tree Hotels announces the signing of its new property in Madhya Pradesh KEI Industries Ltd declares interim dividend of Rs. 4.50

KEI Industries Ltd declares interim dividend of Rs. 4.50 Jindal Stainless Ltd declares interim dividend of Rs. 1

Jindal Stainless Ltd declares interim dividend of Rs. 1

Stock Report

AU Small Finance Bank Limited - Q3FY24 Business Update

Posted On : 2024-01-04 15:48:33( TIMEZONE : IST )

AU Small Finance Bank Limited has announced information pertaining to its performance for the quarter ended on December 31, 2023.

Management Commentary

The macro environment during Q3'FY24 continued to warrant caution and prudence amidst tight liquidity, higher interest rate and persistent competitive landscape for deposits. The Bank continues to execute its strategy of building a sustainable, secured and retail franchise and Q3'FY24 saw strong delivery on all parameters including deposit mobilisation and credit growth. Some key operating highlights for the quarter were as follows:

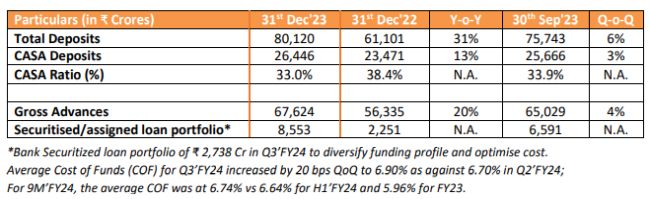

- Deposit franchise continued to expand with both Urban branch banking group and Swadesh banking group executing on their plans, resulting in overall deposits crossing ₹ 80,000 Crore mark with a healthy growth of 6% QoQ and 31% YoY. CASA deposits continued to consolidate with incremental CASA growth of 3% QoQ and 13% YoY.

- Advances growth remained strong with disbursement sustaining across both Retail assets group and Commercial banking group. Asset quality continues to follow the seasonal trend and remains within the range.

- The digital initiatives continue to gain momentum under the umbrella of Digital Banking group with overall registrations on AU 0101 crossing 2.5 million users during Q3'FY24. Additionally, the credit card business has now reached 8.3 Lac+ live credit cards with monthly run rate of ~50k cards whereas the Bank opened 70k+ savings account via Video banking + AU 0101 during the quarter.

- Project for operationalising Authorised Dealer Category - I license (AD Cat-I) remains on track for a commercial launch in next few months

- Merger Update: The progress is on track, both Fincare SFB and AU SFB received shareholder's approval in Nov'23 and have filed the necessary applications for approval with Competition Commission of India (CCI) and the Reserve Bank of India (RBI)

Note: The above information for Q3'FY24 is provisional and being released ahead of the official announcement of the financial results for the quarter ended December 31, 2023 and is subject to review and approval by the Audit Committee, Board of Directors, and Statutory Auditors of the Bank.

Shares of AU Small Finance Bank Limited was last trading in BSE at Rs. 769.95 as compared to the previous close of Rs. 766.40. The total number of shares traded during the day was 14562 in over 1115 trades.

The stock hit an intraday high of Rs. 774.00 and intraday low of 754.50. The net turnover during the day was Rs. 11119282.00.