GRSE Adds Third ASW SWC to Navy's Arsenal with INS Anjadip Commissioning

GRSE Adds Third ASW SWC to Navy's Arsenal with INS Anjadip Commissioning Vedanta Ltd declared preferred bidder of Karnapodikonda bauxite block

Vedanta Ltd declared preferred bidder of Karnapodikonda bauxite block Karur Vysya Bank to open new branch at Pattabiram, Chennai

Karur Vysya Bank to open new branch at Pattabiram, Chennai Lemon Tree Hotels signs new hotel in Akola, Maharashtra

Lemon Tree Hotels signs new hotel in Akola, Maharashtra Kabra Extrusiontechnik Ltd awarded Rs. 133 crore order

Kabra Extrusiontechnik Ltd awarded Rs. 133 crore order

Stock Report

AU Small Finance Bank Limited - Q4 FY24 Business Updates

Posted On : 2024-04-07 15:11:09( TIMEZONE : IST )

AU Small Finance Bank Limited has announced information pertaining to its performance in the quarter and year ended March 31, 2024.

Merger Update

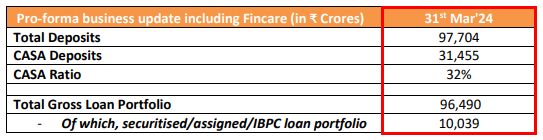

Post receiving RBI approval on March 4, 2024, the merger of Fincare SFB with and into AU SFB became effective from April 1, 2024, and the deposit rates at Fincare branches have been aligned to AU deposit rates w.e.f. April 1, 2024. Further, the integration process is expected to get completed over the next 9 months.

Some key business numbers on pro-forma merged basis are as below:

Management Commentary -

During Q4'FY24, the macro landscape remained challenging marked by intense competition among banks for deposit mobilisation amidst an ongoing deficit in the systemic liquidity, although there was some easing compared to the Q3'FY24. The credit environment continued to remain buoyant during the quarter supported by strong on-ground activity with sustained uptick in demand across businesses.

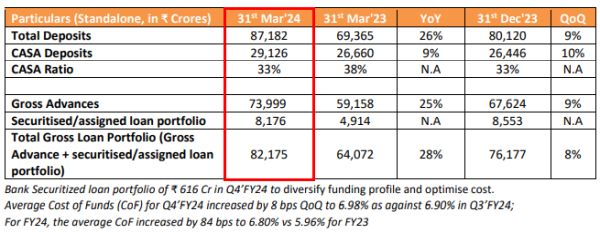

Amidst this backdrop, Bank delivered a strong operational performance with 9% QoQ growth in its deposits and advances. Bank continues to execute on its strategy of a deposit led asset growth and looks to gain further scale and efficiency with the amalgamation of Fincare SFB into the Bank. Some key operating highlights for the quarter were as follows:

- As part of our strategy of building a sustainable business model, the Bank had emphasized of enhanced focus on protecting/growing our incremental margins. We have started seeing some green shoots with the incremental cost of funds for Q4'FY24 declining by 4bps to 7.71%, compared to Q3'FY24 whereas the incremental disbursement yields increased by 8bps to 13.56%, compared to Q3'FY24

- Amidst the strong competition for deposits, both the liability groups - Urban branch banking and Swadesh banking - continued to expand and execute on their respective strategies, resulting in overall deposits growth of 9% QoQ and 26% YoY with total deposits crossing ₹ 87,000 Cr. This was led by strong CASA mobilisation with incremental CASA deposit growing by 10% QoQ

- Advances growth continues to remain strong across both Retail assets and Commercial banking assets and Bank achieved highest ever disbursement in the month of March'24. The asset quality continues to remain within the long-term range. Bank securitised loans worth ₹ 616 Cr during the quarter and the Bank's overall Gross Loan portfolio grew by 8% QoQ and 28% YoY

- Bank carries sufficient liquidity in the form of LCR investments and high quality non-SLR investments

- Bank has started offering product and services to customers under the Authorised Dealer Category - I (AD Cat-I) licence during the quarter

- During the quarter, Shri H R Khan - Independent Director on the Board and ex-Deputy Governor, RBI, took over as the Chairman of the Bank w.e.f. January 30, 2024

Note: The above information for Q4'FY24 is provisional and being released ahead of the official announcement of the financial results for the quarter and year ended March 31, 2024, and is subject to review and approval by the Audit Committee, Board of Directors, and Statutory Auditors of the Bank.

Shares of AU Small Finance Bank Limited was last trading in BSE at Rs. 634.30 as compared to the previous close of Rs. 621.20. The total number of shares traded during the day was 216031 in over 8800 trades.

The stock hit an intraday high of Rs. 636.95 and intraday low of 614.15. The net turnover during the day was Rs. 136072213.00.