Dhanlaxmi Bank reports net profit of Rs. 23.88 crores in Q3 FY2026

Dhanlaxmi Bank reports net profit of Rs. 23.88 crores in Q3 FY2026 Wendt India Ltd Q3 FY2026 consolidated PAT at Rs. 2.98 crore

Wendt India Ltd Q3 FY2026 consolidated PAT at Rs. 2.98 crore Tata Communications Ltd Q3 FY26 consolidated profit jumps to Rs. 365.28 crores

Tata Communications Ltd Q3 FY26 consolidated profit jumps to Rs. 365.28 crores Sangam India Ltd consolidated Q3FY26 PAT increases to Rs. 24.47 crores

Sangam India Ltd consolidated Q3FY26 PAT increases to Rs. 24.47 crores Thangamayil Jewellery Ltd reports net profit of Rs. 104.78 crores in Q3FY26

Thangamayil Jewellery Ltd reports net profit of Rs. 104.78 crores in Q3FY26

Stock Report

Adani Wilmar Ltd - Quarterly Updates - Q3 FY 2023-24

Posted On : 2024-01-05 22:48:44( TIMEZONE : IST )

This release provides a preliminary update on the standalone performance highlighting the key trends and operational developments during the quarter that ended on December 31, 2023. This will be later followed by a detailed disclosure of financial results and earnings presentation once the board approves the financial results for the quarter.

The Company continued to grow well during the quarter, driven by increasing penetration of packaged oil and food. In the branded oil and foods, the Company benefited from the elevated demand from the festive and wedding season and recorded the best-ever volumes during the quarter, growing over a strong base quarter. Rural sales were also robust with continued demand for branded staples.

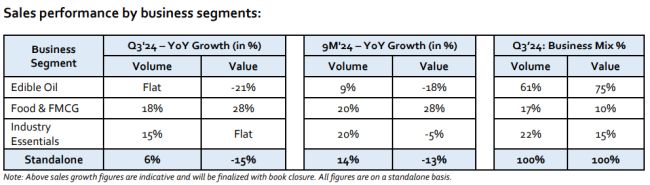

During the quarter, the Company recorded overall volume growth of 6%, however, lower pricing of edible oils in line with the fall in the cost of raw materials (crude edible oils), resulted in a revenue decline of 15% YoY.

In both Oil and Foods, branded products account for around 80% of the business and have been growing at a faster rate. With the easing of the global edible oil prices, our branded edible oils volume growth has been strong during the year, with 4% YoY growth during the quarter and 16% YoY growth in 9M FY'24.

However, forthe overall edible oils segment, volume stayed flat YoY in Q3 FY'24 due to subdued demand from institutional clients and registered a growth of 9% YoY in 9M FY'24.

In the Food & FMCG segment, revenue from branded products in the domestic market has been growing at 40% YoY or higher for the last nine quarters. On the export front, the food business has been impacted by the restrictions on exports for the last three quarters, yet strong domestic sales have led to ~28% YoY revenue growth for the overall Food & FMCG segment in both Q3 as well as YTD.

The Company has a unified system across processes as a pan-India player, however at customer-end, the Company is progressively using more regional approaches to drive deeper penetration in the local markets. This includes state or district level pricing decisions, launching regional varieties, area specific SKU sizes, product labeling in vernacular languages and packaging depicting local dishes. Our stronger products in the local markets are being leveraged to cross-sell other product lines in the retail outlets. The Company is able to leverage its fast-selling SKUs of various edible oils to promote the trial of its food products through combo offers.

As the food business is scaling-up and has built a steady consumer demand, it enables us to better leverage our edible oil distributors. The Company is also focused on improving the sales capabilities of our General Trade distribution system. In a customer centric approach, our salesmen can now sell the entire range of our products to the retail outlets, with sales function using customized approaches for different categories of outlets. With the large headroom available for distribution expansion, the focus stayed on increasing our network, particularly in rural towns and southern states, ensuring a deeper penetration in existing towns and higher throughput from penetrated outlets. The Company is on track to more than double its rural town coverage during the financial year from ~13,000 towns to 30,000+ rural towns by the end of this financial year. The throughput of the new outlets will gradually increase in the coming years. The Company is also increasing its digitalization efforts to improve the fill rates.

The Company released a new brand campaign, featuring Akshay Kumar, to showcase the entire range of edible oils and foods under 'Fortune', continuing with the overarching message of "Ghar ka khana, ghar ka khana hota hai".

The export of branded products, particularly in foods, is a big opportunity on the back of the large Indian diaspora. We have recently started capturing this opportunity with a dedicated export team to set up distribution channels and develop the markets. The Company has been adding new markets and our branded products are now available in 38 countries across six continents.

Edible Oil

The branded products grew by 4%, leading to an improvement in our market share (ROCP MAT Nov'23), however, the overall sales volume remained flat YoY due to lower demand from institutional customers. The segment began the quarter on a high note and witnessed the highest ever sale volume in October, driven by strong demand resulting from the festive and wedding season. However, post-Diwali sales were subdued due to excessive buying prior to the season. In December month, falling edible oil prices led to destocking at distributors and retailers impacting the sales volume.

The business also launched a new campaign for 'Fortune Kachi Ghani Mustard Oil (KGMO)', showcasing the connection of mustard oil with the culture and traditions of India. The Company collaborated with Malini Awasthi, UP's renowned folk singer, to create music that resonates with the local population. The campaign was run across the Hindi belt states.

The business continues to focus on improving the reach and quality of distribution, particularly in Rural areas & South, gaining market share in under-indexed states and strengthening the 'Fortune' and 'King's' brands.

Food & FMCG

The Food & FMCG segment revenue grew by 28% YoY, during the quarter, despite the drag of restrictions on rice exports.

The wheat business has been making multiple interventions in southern states, where branded penetration of industry is higher, along with higher profitability. The business also leased additional wheat milling capacity in the South, enabling it to ensure freshness of product and distribute in smaller lots. This has significantly improved the volume offtake, increased the penetration in retail outlets and led to strong demand for our products from the retailers in the South. The Company will pursue rangeselling of its product portfolio in the South, on the back of two strong products - Fortune Sunflower Oil and Fortune Chakki Fresh Atta.

The Company conceptualized and executed a pioneering promotional event in the category of flours, in all the ~3,800 stores of one of the largest retailers of India. The flour festival, for the promotion of Atta, Sooji, Rawa, Maida and Besan in October and November created a strong visibility of our various flours and registered strong sales in the retail chain.

A new TV campaign, 'Roti ki Mehnat', was launched for 'Fortune Chakki Fresh Atta', highlighting the convenience of the easy-to-knead atta that helps its consumers to keep up with their busy lifestyles.

Our Rice business has seen healthy growth in both Basmati and Regional rice with an integrated play of two brand strategy - Kohinoor and Fortune.

In Q2'24, the Company launched the biryani kit under the Fortune brand in the export market, which accounted for 40%+ volume of packs sold during Q3.

Shares of Adani Wilmar Limited was last trading in BSE at Rs. 377.95 as compared to the previous close of Rs. 381.50. The total number of shares traded during the day was 168707 in over 4236 trades.

The stock hit an intraday high of Rs. 384.20 and intraday low of 375.90. The net turnover during the day was Rs. 63925946.00.