P N Gadgil Jewellers Ltd opens new store at Prozone Mall, Chikalthana

P N Gadgil Jewellers Ltd opens new store at Prozone Mall, Chikalthana BharatRohan signed an Engagement Letter with KPI Green OMS to deploy its Drone/UAV based Sub-Visual Asset Intelligence Solution

BharatRohan signed an Engagement Letter with KPI Green OMS to deploy its Drone/UAV based Sub-Visual Asset Intelligence Solution Savita Oil Technologies Ltd commissions Phase 2 of Synthetic Ester Manufacturing Plant at Mahad

Savita Oil Technologies Ltd commissions Phase 2 of Synthetic Ester Manufacturing Plant at Mahad  NCC Limited receives order worth Rs. 326.06 crores in Feb 2026

NCC Limited receives order worth Rs. 326.06 crores in Feb 2026 Concord Control Systems Ltd secures Rs. 53.73 Crore KAVACH 4.0 Order from Indian Railways

Concord Control Systems Ltd secures Rs. 53.73 Crore KAVACH 4.0 Order from Indian Railways

Market Commentary

DBS Macro strategy: INR volatility weighs on carry appetite

Posted On : 2018-04-26 12:14:17( TIMEZONE : IST )

Ms. Radhika Rao, India Economist, DBS Bank and Philip Wee, FX Strategist, DBS Bank

India

April has been a volatile month for the Indian government bond markets. 10Y yields started the month on a softer note at 7.3% (generic quote), eased to 7.12% lows before springing back to 7.7% yesterday. Buying interests emerged at highs, but swiftly faded away as a weakening rupee, high oil prices and sustained rise in US yields (10Y USTs briefly tested past 3%, a first in four years). The Indian authorities were also rumoured to have stepped in earlier this week to temper the sharp rise in yields.

In the near-term, we expect any dip in the 10Y yield to be fleeting. Hawkish undertones in the recent Minutes of the April meeting, sticky core inflation and rupee depreciation have raised the scope for a pre-emptive rate hike in Q318. The rupee continues to underperform in Asia, closing in on the region's worst performer (-4%/USD) - Philippine peso on year-to-date basis. India's cyclical rebound is also overshadowed by rising oil prices - Brent is near three-year highs of USD75pb while the Indian crude basket is back at late-2014 levels. This risks widening the trade/current account balances and raising financing requirements.

But financing risks are back on the table as foreign portfolio investors have turned cautious; sold over USD1bn worth debt holdings this month, outpacing equity outflows of USD0.7bn Trading activity also show the dominant player in the bond markets - domestic public-sector banks pare their exposure. Subdued appetite for bonds, however, meets a steady supply pipeline. A recent debt quota auction witnessed lukewarm demand. States sold less-than-planned quantum for a second consecutive week - INR61bn vs planned INR116bn. The central government is due to auction INR120bn worth issuances across four maturities on Friday.

INR liquidity remains in surplus of over INR1trn this month, but has been narrowing in the past week. Tax outflows will keep the surplus in check, while late-month increase in government spending must provide some relief next week. With our near-term targets tested, rangebound action in the 10Y is likely to be followed by a drift towards 7.9%. With rate hike risks back on the table, 7% is likely to mark a floor for the 2Y yields (generic quote).

FX

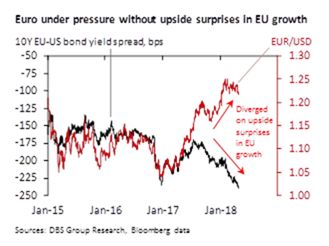

The euro finally closed below 1.22 against the US dollar on a sustained rise in US 10Y bond yield above 3%. Unlike last October, when the euro also fell below its 100-day moving average, the odds have lessened for the euro to appreciate again. First, the Fed is no longer puzzled about "growth without inflation" and has upgraded its US growth and inflation outlook. More importantly, the Eurozone economy is no longer surprising on the upside. Weak data flow has led the German Economy Ministry to lower its 2018 growth forecast to 2.3% from 2.4% yesterday. Last week, the median EU growth consensus compiled by Bloomberg has also fallen to 2.3% from 2.4%. These downgrades came not long after the European Central Bank (ECB) staff lifted on 8 March its 2018 EU growth projections to 2.4% from 2.3%.

The ECB will, at its governing council meeting today, seek to play down growth concerns. Apart from acknowledging that growth may have peaked, the ECB will maintain confidence in the growth momentum to continue and keep the door open to end its asset purchases program in September. The ECB's confidence on growth, however, will not be enough to placate speculators who have amassed record high long euro positions betting on faster EU growth and faster ECB normalization. Without an optimistic EU growth outlook, the euro looks overly strong relative to its wide negative bond yield differential against the US. Our view remains for EU's weaker relative fundamentals vs the US to push the euro below 1.20 again.