Tamilnad Mercantile Bank Credits Oracle Fusion Cloud Applications for AI-Powered Efficiency Gains

Tamilnad Mercantile Bank Credits Oracle Fusion Cloud Applications for AI-Powered Efficiency Gains Nifty Rises for The Third Straight Session, Closes at One-Month High

Nifty Rises for The Third Straight Session, Closes at One-Month High Skybags Partners with Chennai Super Kings as Official Luggage Partner for 2026

Skybags Partners with Chennai Super Kings as Official Luggage Partner for 2026 Persistent Recognized as the Fastest Growing IT Services Brand Globally in the 2026 Brand Finance IT Services 25 Report

Persistent Recognized as the Fastest Growing IT Services Brand Globally in the 2026 Brand Finance IT Services 25 Report Axis Bank launches Gold Loan for MSMEs with high loan-to-value and same-day disbursement

Axis Bank launches Gold Loan for MSMEs with high loan-to-value and same-day disbursement

Stock Report

HDFC Bank - Q1 FY2025-26 Update

Posted On : 2025-07-04 17:08:34( TIMEZONE : IST )

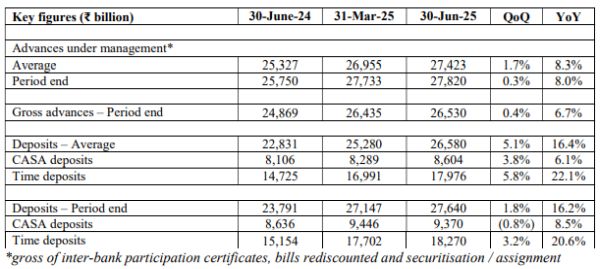

The Bank's average advances under management (advances grossing up for inter-bank participation certificates, bills rediscounted and securitisation / assignment) were ₹ 27,423 billion for the June 2025 quarter, a growth of around 8.3% over ₹ 25,327 billion for the June 2024 quarter, and a growth of around 1.7% over ₹ 26,955 billion for the March 2025 quarter.

The Bank's period end advances under management were approximately ₹ 27,820 billion as of June 30, 2025, a growth of around 8.0% over ₹ 25,750 billion as of June 30, 2024, and a growth of around 0.3% over ₹ 27,733 billion as of March 31, 2025.

The Bank's period end gross advances aggregated to approximately ₹ 26,530 billion as of June 30, 2025, a growth of around 6.7% over ₹ 24,869 billion as of June 30, 2024.

During the quarter ended June 30, 2025, the Bank securitised / assigned loans of ₹ 33 billion as a strategic initiative.

The Bank's average deposits were ₹ 26,580 billion for the June 2025 quarter, a growth of around 16.4% over ₹ 22,831 billion for the June 2024 quarter, and around 5.1% over ₹ 25,280 billion for the March 2025 quarter.

The Bank's average CASA deposits were ₹ 8,604 billion for the June 2025 quarter, a growth of around 6.1% over ₹ 8,106 billion for the June 2024 quarter, and around 3.8% compared to ₹ 8,289 billion for the March 2025 quarter.

The Bank's average time deposits were ₹ 17,976 billion for the June 2025 quarter, a growth of around 22.1% over ₹ 14,725 billion for the June 2024 quarter, and around 5.8% compared to ₹ 16,991 billion for the March 2025 quarter.

The Bank's period end deposits were approximately ₹ 27,640 billion as of June 30, 2025, a growth of around 16.2% over ₹ 23,791 billion as of June 30, 2024, and a growth of around 1.8% over ₹ 27,147 billion as of March 31, 2025.

The Bank's period end CASA deposits were approximately ₹ 9,370 billion as of June 30, 2025, a growth of around 8.5% over ₹ 8,636 billion as of June 30, 2024, and were lower by around 0.8% over ₹ 9,446 billion as of March 31, 2025.

The Bank's period end time deposits were approximately ₹ 18,270 billion as of June 30, 2025, a growth of around 20.6% over ₹ 15,154 billion as of June 30, 2024, and a growth of around 3.2% over ₹ 17,702 billion as of March 31, 2025.

Key business volumes are as under:

The results of the Bank as of June 30, 2025, will be subjected to a limited review by the statutory auditors of the Bank.

Shares of HDFC Bank Limited was last trading in BSE at Rs. 1985.65 as compared to the previous close of Rs. 1985.70. The total number of shares traded during the day was 286447 in over 8427 trades.

The stock hit an intraday high of Rs. 2007.90 and intraday low of 1984.00. The net turnover during the day was Rs. 571601158.00.