Ramky Infrastructure Wins ₹1,401.84 Crore Contract from Maharashtra Industrial Township Ltd for Dighi Port Industrial Area Project

Ramky Infrastructure Wins ₹1,401.84 Crore Contract from Maharashtra Industrial Township Ltd for Dighi Port Industrial Area Project Moneyboxx Finance Raises ₹33.4 Crore in Equity to Accelerate Growth and Strengthen Capital Base

Moneyboxx Finance Raises ₹33.4 Crore in Equity to Accelerate Growth and Strengthen Capital Base Provigil Surveillance Ltd receives LOA for order worth Rs. 6.16 crore

Provigil Surveillance Ltd receives LOA for order worth Rs. 6.16 crore Hannah Joseph Hospital receives award

Hannah Joseph Hospital receives award Shree Refrigerations Ltd plans inauguration of new facility

Shree Refrigerations Ltd plans inauguration of new facility

Stock Report

Sobha Ltd - Q2 FY2024-25 Real Estate Operational Update

Posted On : 2024-10-07 23:06:57( TIMEZONE : IST )

India's GDP grew by 6.7% in Q1-FY25 vs 7.8% in Q4-FY24, attributed to reduced government spending and slowdown in economic activity ahead of the general elections. In Q2-FY25, economic activity rebounded, reflected in robust GST collections with 14.4% and 10.0% YoY growth in July and August of 2024. Real Estate sector has very close correlation with overall GDP growth. Despite temporary slowdown and amidst ongoing geopolitical tensions, India's growth outlook remains intact, as reiterated recently by IMF, who has revised India's GDP forecast upwards by 20 bps to 7.0% for FY 2024-25. This positive job-creating growth shall continue to result in higher migration to urban centres and Residential Real Estate sector is a direct beneficiary of the same. We expect demand to sustain and have a robust inventory in ongoing and forthcoming projects across our cities of operations to capture the same.

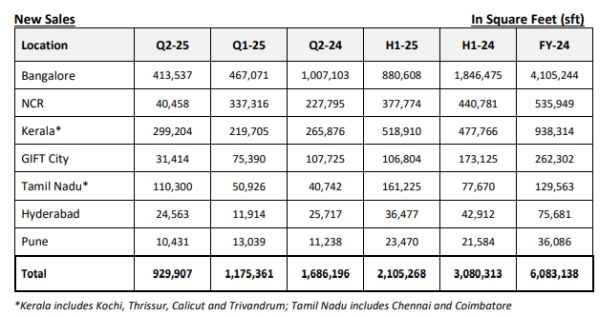

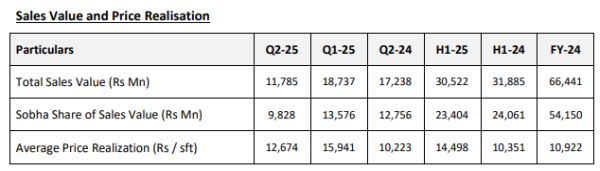

In Q2-FY25, we sold new area of 0.93 mn sft with sales value of Rs. 11.79 bn at an average price realization of Rs. 12,674 per sft. For the first half of FY 2024-25, our total sales value stands at Rs. 30.52 bn vs. Rs. 31.89 bn in H1 of FY 2023-24. Bangalore achieved sale value of Rs. 6.09 bn in Q2-FY25, contributing 51.8% to overall sales in Q2-FY25. Kerala region had a strong quarter, recording growth of 36.2% in new sale area compared to previous quarter, contributing sale value of Rs. 3.38 bn. Tamil Nadu region's sale value has more than doubled compared to previous quarter, supported by new project launches in Q1-25.

The summarized performance for the quarter ended September 30, 2024 is given below:

Key Operational Highlights - Q2 and H1 of FY 2025

- In H1-FY25, SOBHA launched 3.53 mn sft spread over 5 projects vs. no launches in H1-FY24

- Average Price realization in H1-FY25 improved by 32.7% compared to FY24, on account of contribution from projects in Gurgaon and price improvement across other projects as well

- Kerala witnessed best ever quarterly sale of 0.3 mn sft with value of Rs. 3,381 mn. As for H1-FY25 also, Kerala region recorded historic best half yearly performance

New launches - Q2-FY25

We launched SOBHA Infinia with total saleable area of 490,254 sft, in Bangalore.

The project is in close proximity to Koramangala, with excellent access and connectivity to other major areas like HSR Layout, ORR and Marathahalli. This luxury project is spread over 2.9 Acres comprising 196 units of 3 & 4 BHK configurations (sizes ranging from 1,768 sft to 3,264 sft), with a 22,000 sft clubhouse.

Shares of Sobha Limited was last trading in BSE at Rs. 1739.10 as compared to the previous close of Rs. 1793.40. The total number of shares traded during the day was 15813 in over 1663 trades.

The stock hit an intraday high of Rs. 1771.25 and intraday low of 1706.25. The net turnover during the day was Rs. 27430414.00.