Zydus receives final approvals from USFDA for Ivermectin Tablets USP, 3 mg and Dapsone Tablets USP, 25 mg and 100 mg

Zydus receives final approvals from USFDA for Ivermectin Tablets USP, 3 mg and Dapsone Tablets USP, 25 mg and 100 mg Nukleus Office Solutions Signs LOI for New Noida Co-Working Centre

Nukleus Office Solutions Signs LOI for New Noida Co-Working Centre ICRA Assigns Strong AA; Stable Rating to Adani Power's Additional Loans

ICRA Assigns Strong AA; Stable Rating to Adani Power's Additional Loans Baazar Style Retail Ltd opens new Style Baazar store at Midnapore

Baazar Style Retail Ltd opens new Style Baazar store at Midnapore TANFAC Industries Ltd revises record date for sub-division of equity shares

TANFAC Industries Ltd revises record date for sub-division of equity shares

Stock Report

Sobha Ltd - Real Estate Operational Update - Q3 FY2023-24

Posted On : 2024-01-05 09:06:33( TIMEZONE : IST )

India's steady march on growth continues, even in the backdrop of widening geo-political fissures and apprehensions of economic slowdown in the developed countries, thereby reinforcing further optimism in the economy. RBI's revision of FY24 GDP growth outlook to 7.0% from 6.5% earlier validates the confidence. Despite high growth, inflation has been contained, enabling RBI to keep the interest rates unchanged since February 2023, which augured well for the real estate sector.

Demand for residential real estate, in this positive economic environment has been at a historic high. Heightened economic activity is driving new job creation, more so in the urban areas, leading to significant increase in migrating population mix across our main cities of operations. A combination of optimism, increased income levels, new job creation, migration and interest rate stability has supported a steady demand scenario, witnessed in our improving sales performance quarter on quarter.

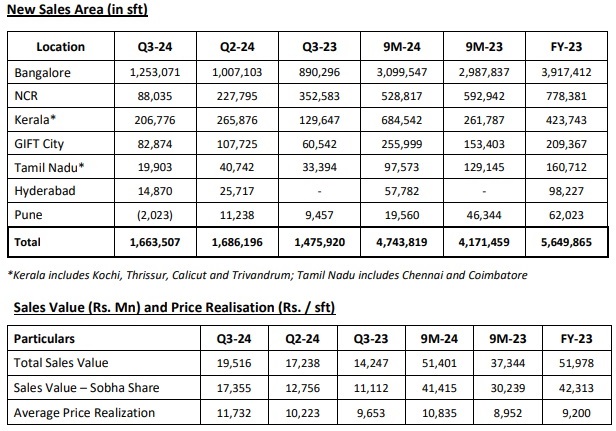

Given this backdrop, Q3 FY 2024 has been the best ever sales quarter for SOBHA, with a value of Rs. 19.52 bn at an average price realization of Rs. 11,732 / sft, while maintaining a steady performance in new area sold of 1.66 mn sft. Bangalore has achieved highest ever quarterly sales of 1.25 mn sft with a value of Rs. 14.99 Bn, led by successful launch of SOBHA Neopolis in beginning of the quarter. NCR region continued with it's strong momentum completing the sale of Sobha City in Gurgaon. Kerala region clocked a 59.5% growth in new sales area over Q3-FY23. GIFT City's remarkable success story continued, with 9M-FY24 new sales area registering a growth of 22.7% over sales of full year of FY 2023.

We launched 2 new projects this quarter with a total saleable area of 3.84 mn sft. Cash flows for the quarter remained strong and has resulted in further net debt reduction.

The summarized operational performance for quarter ended December 31, 2023, is given below:

Key Operational Highlights of Q3-FY24

- Achieved highest ever quarterly sales value of Rs. 19.52 bn, registering a growth of 37.0% over Q3-FY23 and 13.2% compared to preceding quarter Q2-FY24

- Sobha's share of sales value was also the highest ever, at Rs. 17.36 bn, with increase of 56.2% over Q3-FY23 and 36.1% compared to Q2-FY24

- Average Price realization improved to Rs. 11,732 /sft, up by 14.8% over Q2-FY24, supported by new project launch of SOBHA Neopolis, which contributed to 53.9% of overall sales value

- Quarterly new sales area remained steady at 1.66 mn sft, with growth of 12.7% over Q3-FY23

- Achieved highest ever quarterly sales of 1.25 mn sft in Bangalore

Key Operational Highlights of 9M-FY24

- For 9M-FY24 we have achieved historic best sales performance for the corresponding period across all parameters -

* Sales area grew by 12.7% over 9M-FY23 to 4.74 mn sft

* Sales value registered growth of 37.6% to clock Rs. 51.40 bn

* Average realization improved by 21.0% to Rs. 10,835 per sft

New launches in Q3-FY24

Launched 2 new residential projects in this quarter with a total saleable area of 3,839,897 sft

SOBHA Neopolis - Spread over 25.89 Acres with saleable area of 3,440,634 sft in Bangalore. The project comprises of 19 wings and 1,875 units (configurations of 1/ 3 / 4 BHK) with sizes ranging from 660 sft to 2,481 sft

SOBHA Metropolis - Phase 3 of the luxury project with saleable area of 399,263 sft was launched in Thrissur, Kerala. 160 apartments (2 / 3 / 4 BHK configurations) with sizes ranging between 1,885 sft to 2,843 sft are spread across 2 towers

Shares of Sobha Limited was last trading in BSE at Rs. 1297.50 as compared to the previous close of Rs. 1116.65. The total number of shares traded during the day was 648827 in over 22512 trades.

The stock hit an intraday high of Rs. 1339.95 and intraday low of 1122.50. The net turnover during the day was Rs. 841538129.00.