GRSE Adds Third ASW SWC to Navy's Arsenal with INS Anjadip Commissioning

GRSE Adds Third ASW SWC to Navy's Arsenal with INS Anjadip Commissioning Vedanta Ltd declared preferred bidder of Karnapodikonda bauxite block

Vedanta Ltd declared preferred bidder of Karnapodikonda bauxite block Karur Vysya Bank to open new branch at Pattabiram, Chennai

Karur Vysya Bank to open new branch at Pattabiram, Chennai Lemon Tree Hotels signs new hotel in Akola, Maharashtra

Lemon Tree Hotels signs new hotel in Akola, Maharashtra Kabra Extrusiontechnik Ltd awarded Rs. 133 crore order

Kabra Extrusiontechnik Ltd awarded Rs. 133 crore order

Stock Report

RBL Bank Limited - Q3 FY2024 Business Update

Posted On : 2024-01-04 21:50:55( TIMEZONE : IST )

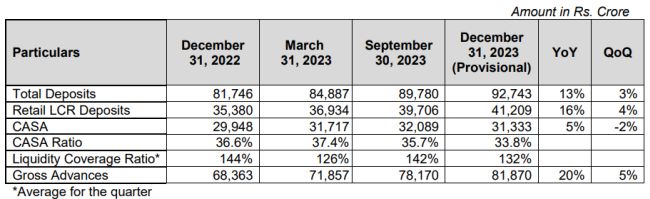

RBL Bank Limited has announced the business update for the period ended December 31, 2023.

Retail advances grew 32% YoY while wholesale advances grew 6% YoY for the quarter ended December 31, 2023. The mix of retail: wholesale advances was approx. 58:42.

The Bank continues to focus on growing the share of granular retail deposits in the overall deposit mix, with retail deposits (as per LCR definition) at approx. 44.4% as against 43.3% as of December 31, 2022.

The above information is provisional and being released ahead of the official announcement of the financial results for the quarter ended December 31, 2023, which is subject to approval by the Audit Committee of the Board of Directors, the Board of Directors and limited review by the Statutory Auditors of the Bank.

Shares of RBL Bank Limited was last trading in BSE at Rs. 286.00 as compared to the previous close of Rs. 284.85. The total number of shares traded during the day was 273155 in over 1998 trades.

The stock hit an intraday high of Rs. 287.35 and intraday low of 282.75. The net turnover during the day was Rs. 77901954.00.