GRSE Adds Third ASW SWC to Navy's Arsenal with INS Anjadip Commissioning

GRSE Adds Third ASW SWC to Navy's Arsenal with INS Anjadip Commissioning Vedanta Ltd declared preferred bidder of Karnapodikonda bauxite block

Vedanta Ltd declared preferred bidder of Karnapodikonda bauxite block Karur Vysya Bank to open new branch at Pattabiram, Chennai

Karur Vysya Bank to open new branch at Pattabiram, Chennai Lemon Tree Hotels signs new hotel in Akola, Maharashtra

Lemon Tree Hotels signs new hotel in Akola, Maharashtra Kabra Extrusiontechnik Ltd awarded Rs. 133 crore order

Kabra Extrusiontechnik Ltd awarded Rs. 133 crore order

Stock Report

HDFC Bank - Q2 FY2023-24 Business Update

Posted On : 2023-10-04 13:08:19( TIMEZONE : IST )

HDFC Bank's gross advances aggregated to approximately ₹ 23,545 billion as of September 30, 2023, a growth of around 57.7% over ₹ 14,933 billion as of September 30, 2022 and a growth of around 44.4% over ₹ 16,300 billion as of June 30, 2023. Grossing up for transfers through inter-bank participation certificates and bills rediscounted, the Bank's advances grew by around 60.0% over September 30, 2022 and around 43.0% over June 30, 2023.

As per the Bank's internal business classification, domestic retail loans grew by around 111.5% over September 30, 2022 and around 85.0% over June 30, 2023; commercial & rural banking loans grew by around 29.5% over September 30, 2022 and around 9.5% over June 30, 2023; corporate & other wholesale loans grew by around 8.0% over September 30, 2022 and around 6.0% over June 30, 2023; and non-individual loans of the erstwhile HDFC Limited (eHDFCL) aggregated to approximately ₹ 1,025 billion as of September 30, 2023.

2) The Bank's deposits aggregated to approximately ₹ 21,730 billion as of September 30, 2023, a growth of around 29.9% over ₹ 16,734 billion as of September 30, 2022 and a growth of around 13.6% over ₹ 19,131 billion as of June 30, 2023.

3) The Bank's CASA deposits aggregated to approximately ₹ 8,175 billion as of September 30, 2023, a growth of around 7.6% over ₹ 7,597 billion as of September 30, 2022 and around 0.6% over ₹ 8,130 billion as of June 30, 2023. The Bank's CASA ratio stood at around 37.6% as of September 30, 2023, as compared to 45.4% as of September 30, 2022, and 42.5% as of June 30, 2023.

The above information as of September 30, 2023 is subject to a limited review by the statutory auditors of the Bank.

Additional Information:

4) HDFC Limited amalgamated with and into HDFC Bank on July 01, 2023.

(i) The Bank's gross advances aggregated to approximately ₹ 23,545 billion as of September 30, 2023. Advances grew by around ₹ 1,101 billion in the quarter registering a growth of around 4.9% over the proforma merged advances of ₹ 22,444 billion as of June 30, 2023.

(ii) The Bank's deposits aggregated to approximately ₹ 21,730 billion as of September 30, 2023. Deposits grew by around ₹ 1,092 billion in the quarter registering a growth of around 5.3% over the proforma merged deposits of ₹ 20,638 billion as of June 30, 2023.

(iii) Home loan disbursals during the first quarter post merger were the best ever at ₹ 480 billion. This is a growth of 14.0% over the quarter ending June 30, 2023, and a growth of 10.5% over the quarter ending September 30, 2022.

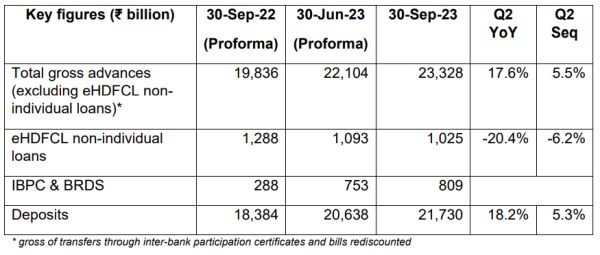

(iv) Key business numbers are given as under:

Shares of HDFC Bank Limited was last trading in BSE at Rs. 1507.95 as compared to the previous close of Rs. 1526.55. The total number of shares traded during the day was 611769 in over 52079 trades.

The stock hit an intraday high of Rs. 1527.00 and intraday low of 1506.00. The net turnover during the day was Rs. 924854676.00.