GRSE Adds Third ASW SWC to Navy's Arsenal with INS Anjadip Commissioning

GRSE Adds Third ASW SWC to Navy's Arsenal with INS Anjadip Commissioning Vedanta Ltd declared preferred bidder of Karnapodikonda bauxite block

Vedanta Ltd declared preferred bidder of Karnapodikonda bauxite block Karur Vysya Bank to open new branch at Pattabiram, Chennai

Karur Vysya Bank to open new branch at Pattabiram, Chennai Lemon Tree Hotels signs new hotel in Akola, Maharashtra

Lemon Tree Hotels signs new hotel in Akola, Maharashtra Kabra Extrusiontechnik Ltd awarded Rs. 133 crore order

Kabra Extrusiontechnik Ltd awarded Rs. 133 crore order

Stock Report

AU Small Finance Bank Ltd - Q2 FY2024 Performance Update

Posted On : 2023-10-04 13:01:06( TIMEZONE : IST )

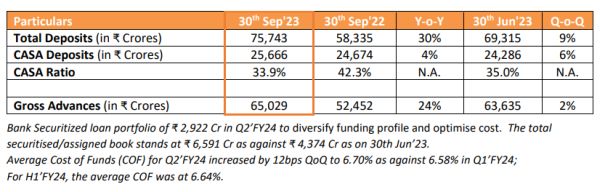

AU Small Finance Bank Ltd has announced its performance update for the quarter ended on September 30, 2023.

Management Commentary - During Q2'FY24, domestic inflationary pressure was higher, and the monsoon progress remained below historical average for the month of August. This, coupled with global macro, ensured that the interest rates remain elevated, and the systemic liquidity continued to remain tight. Amidst this backdrop, Bank once again delivered a stable quarter with growth seen across deposits and disbursements. Some key operating highlights for Q2'FY24 were as follows:

- Despite higher competitive intensity for deposit mobilisation, the Bank grew its overall deposits by 9% sequentially and 30% YoY with CASA deposits growing by 6% QoQ.

- Credit demand remains resilient with disbursement sustaining across products and the Bank continued to see an uptick in disbursement yields on a QoQ basis. Asset quality continues to follow the seasonal trend and remains within the range.

- Bank announced the formation of "Swadesh Banking" - an initiative to bring sharper focus on our inclusive banking by bringing all rural initiatives under one umbrella covering deposits, assets and financial & digital inclusion.

- Bank also formed "Digital Banking" group whereby all the digital business initiatives of the Bank, like Credit card, UPI QR code, Merchant lending, Personal loans, Video Banking, AU 0101 etc., were brought under one leadership to align strategy and bring synergy in our Digital businesses. Notably, Credit card business has now reached 7 Lac+ live credit cards with monthly spend crossing ₹ 1,350 Cr+ in Sep'23. During the quarter, the Bank opened 54,000+ savings account via Video banking + AU 0101.

Note: The above information for Q2'FY24 is provisional and being released ahead of the official announcement of the financial results for the quarter ended September 30, 2023 and is subject to review and approval by the Audit Committee, Board of Directors, and Statutory Auditors of the Bank.

Shares of AU Small Finance Bank Limited was last trading in BSE at Rs. 703.80 as compared to the previous close of Rs. 713.40. The total number of shares traded during the day was 16356 in over 1063 trades.

The stock hit an intraday high of Rs. 715.65 and intraday low of 702.10. The net turnover during the day was Rs. 11568107.00.