Novartis AG Sells 70.68% Stake in Novartis India to New Consortium

Novartis AG Sells 70.68% Stake in Novartis India to New Consortium Meta Infotech Ltd receives order worth Rs. 1.56 crore

Meta Infotech Ltd receives order worth Rs. 1.56 crore V-Mart Honoured with Silver Shield at ICAI Awards for Excellence in Financial Reporting 2024-25

V-Mart Honoured with Silver Shield at ICAI Awards for Excellence in Financial Reporting 2024-25 Arab National Bank Leverages Intellect's eMACH.ai Wholesale Banking Platform

Arab National Bank Leverages Intellect's eMACH.ai Wholesale Banking Platform  Closure of USFDA inspection at Zydus' Injectable plant at Ahmedabad

Closure of USFDA inspection at Zydus' Injectable plant at Ahmedabad

Interesting Articles

ECONOMY for the Fiscal year 2018-19

Posted On : 2018-04-21 17:33:26( TIMEZONE : IST )

By Mr. Ritesh Ashar (Chief strategy officer), KIFS TradeCapital

Confidence of DII's has been seen in the past year which led to new Highs in the market but the major concern will be FII's Flow which need to be harmonized with market. Bypassing the risk of slowdown post-demonetization, the Indian economy is estimated to grow at 7.1% in FY17. The Indian economy is expected to embark on higher economic growth trajectory in FY18 owing to proactive measures taken by the government as well as favorable economic conditions expected to prevail during the course of the year.

As per the recent IMF data Indian economy is to grow at 7.8% v/s 6.7% current where china is expected to slow down. The Reserve Bank of India also expects the economy to grow 7.4% this fiscal.

The year 2017 will be remembered as one of the most vibrant year where both the developed and developing countries expanded and in 2018 it is expected that growth momentum for the world markets will pick up. Hiccups were the part.

The Indian markets were on a roll in 2017 with indices delivering around 27-28 percent return between January and December. Indices clocked fresh milestones frequently after Nifty first hit an all-time high of 10,000 in July. We believe that valuation-wise, the market is going ahead of fundamentals, but over the next three years corporate earnings are seen growing at a CAGR of 15-20 percent, which is quite healthy.

"Optimism was building this year, and we think 2018-2019 could be the year of euphoria & Volatility."

Sectors to watch out for 2018 will be Engineering & Reality, Consumer goods, Banking & Finance, Oil & Gas. Infrastructure thrust to boost job creation, Real estate sector to pick up and consumption sector will be the leaders and will contribute to India's growth story.

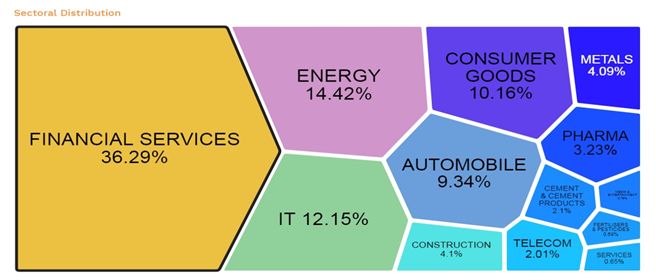

Sector Distribution

Fundamentals of IT Industry

India is the world's largest sourcing destination, accounting for approximately 55 per cent of the US$ 173-178 billion market in 2016-17. The country's cost competitiveness in providing Information Technology (IT) services, which is approximately 3-4 times cheaper than the US, continues to be its Unique Selling Proposition (USP) in the global sourcing market.The sector ranks 3rd in India's total Foreign Direct Investment (FDI) share and has received US$ 27.72 billion of FDI inflows between April 2000 and September 2017.

India's highly qualified talent pool of technical graduates is one of the largest in the world and is available at a cost saving of 60-70 per cent to source countries.Revenue of India's IT industry reached US$ 154 billion and exports stood at US$ 117 billion in 2016-17. The Business Process Management (BPM) segment accounted for 22.22 per cent of the total IT exports during FY17. India's IT-BPM sector is expected to expand to US$ 350 billion by 2025 and BPM is expected to account for US$ 50-55 billion out of the total revenue.

The internet industry in India is likely to double to reach US$ 250 billion by 2020, growing to 7.5 per cent of gross domestic product (GDP). Indian IT exports are projected to grow at 7-8 per cent in 2017-18, in addition to adding 130,000-150,000 new jobs during the same period. (Data Source- NASSCOM)

Fundamentals of BFSI Sector.

Enhanced spending on infrastructure, speedy implementation of projects and continuation of reforms are expected to provide further impetus to growth. All these factors suggest that India's banking sector is also poised for robust growth as the rapidly growing business would turn to banks for their credit needs.Also, the advancements in technology have brought the mobile and internet banking services to the fore. The banking sector is laying greater emphasis on providing improved services to their clients and also upgrading their technology infrastructure, in order to enhance the customer's overall experience as well as give banks a competitive edge.

Outlook - Positive

Fundamentals of Consumption Sector.

Consumption sector is reflection of economic growth .Consumption is vast Cement , Auto, Personal care , Power all forms the part of consumption sector. "Consumption remains a key sector which has an immense potential. We are talking of building 1.2 crore affordable houses over next five years which will create huge consumption demand. And what about the rural economy which is strengthening since last year's normal monsoon. There will be great consumption demand. Some of the consumption giants are DABUR, ITC, TATAGLOBAL, M&M, JUBILIANTFOODS, HUL. 1.2 Crore affordable house will hit the consumption sector a when house is made it requires tiles, doors, water tank etc which is being catered by ASIAN GRANITO, SINTEX IND & Plastics. This will add spark to many industries as illustrated above. We are extremely bullish on consumption sector which is going to be the new theme in 2018-2019.

Even globally we have seen in US, S&P and Europe consumption and IT are outperforming the benchmark index and other sectors as per data.

Outlook - Extremely Positive

Fundamentals of Infrastructure Sector.

Investment in infrastructure development has always acted as a catalyst in the economic growth of India. Infrastructure is treated as a life support system which directly influences all economic activities by increasing the productivity of factors of production and improving quality of life. India has made progress in building infrastructure which has been driver of its growth. Success stories of golden quadrilateral, space programs, integrated housing plans etc have become economically profitable. Affordable housing is the story for 2018 which will take infrastructure to new heights.

India's jump on World Bank's Ease of Doing Business Index is helping build optimism in India's story and is consequently attracting more investors to the country. There is a lot of focus on infrastructural development. The government in the Budget 2018 allocated a massive Rs 5.97 lakh crore to infrastructural development. The report says that with the country aim to pave more than 80,000 kms of roads by March 2022, India's infrastructural development is showing steady growth and it is the reflection of uptick in economy. "Further, it has taken steps to collaborate with international partners to speed up the process of infrastructure building.

Outlook - Positive

Fundamentals of Media & Entertainment Sector.

The Indian media & entertainment sector is expected to grow at a Compound Annual Growth Rate (CAGR) of 13.9 per cent, to reach US$ 37.55 billion by 2021 from US$ 19.59 billion in 2016, outshining the global average of 4.2 per cent.

Over FY 2016-21, radio will likely grow at a CAGR of 16.1 per cent, while digital advertising will grow at 30.8 per cent. The largest segment, India's television industry, is expected to grow at a CAGR of 14.7 percent; while print media is expected to grow at a CAGR of 7.3 percent. India is one of the highest spending and fastest growing advertising market globally.

Outlook - Positive

Fundamentals of Metal Sector.

World steel demand growth is beginning to face a cyclical upturn. Consumption demand is expected to pick up on the back of the momentum in global economic growth. Robust growth on the back of the government's thrust on infrastructure development, real estate and automobiles. The New Steel Policy, 2017, envisages an increase in per capita consumption from the present 60 kg to 160 kg by 2030 backed by a target of 300 mt steel making capacity. Global conditions added spark to Metal sector where aluminum companies has outperformed.

Outlook - Positive

Fundamentals of Energy Sector.

The Government of India is planning to introduce a new policy to encourage the use of biofuels in transport fuel and is looking at an investment of Rs 1 lakh crore (US$ 15.64 billion) in the entire value chain. The Government of India plans to build a nine million tonne (MT) refinery in Rajasthan as well as a 60 MT refinery in Maharashtra, auction oil and gas fields, increase use of liquefied natural gas (LNG), and is in discussions with Saudi Arabian Oil Co (Saudi Aramco) regarding investments in India. India's oil demand is expected to grow at a CAGR of 3.6 per cent to 458 Million Tonnes of Oil Equivalent (MTOE) by 2040, while demand for energy will more than double by 2040 as economy will grow to more than five times its current size India is expected to be one of the largest contributors to non-OECD petroleum consumption growth globally. Oil imports rose sharply year-on-year by 27.89 per cent to US$ 9.29 billion in October 2017. India's oil consumption grew 8.3 per cent year-on-year to 212.7 million tonnes in 2016, as against the global growth of 1.5 per cent, thereby making it the third-largest oil consuming nation in the world.

India is the fourth-largest Liquefied Natural Gas (LNG) importer after Japan, South Korea and China, and accounts for 5.8 per cent of the total global trade. Domestic LNG demand is expected to grow at a CAGR of 16.89 per cent to 306.54 MMSCMD by 2021 from 64 MMSCMD in 2015.

Why negative? Rising oil prices is one of the biggest risks to the Indian economy as in next fiscal year as it could shrink the income and expenditure. As per data India has benefited from the low oil prices for the last three years but about 45% rise in crude prices since the middle of 2017 appear to wipe out that advantage. "It is estimated that a $10 per barrel increase in the price of oil reduces growth by 0.2-0.3 percentage points, increases WPI inflation by about 1.7 percent.

Outlook - Negative

Fundamentals of Pharma Sector.

The pharma sector funds have been going through a bad phase since the last three years. Following are the reasons Large part of the revenue comes from the US market, Pharma companies have been facing compliance issues, The Indian pharma has specifically being impacted by demonetization and to some extent GST, So from this quarter onwards, we should start seeing the long-term growth catching up in India, Pharma is defensive sector & US FDA issues are getting stabilized for all. In pharma space we have seen huge consolidation going on over the years and we expect the pharma industry to bounce back with the wing which it had opened in 2010. There are major issues getting resolved in pharma companies like US FDA was the biggest concerns. Sun Pharma, Lupin , Biocon all of them have seen positive results indicating a comeback with swing.

Outlook - Negative

Fundamentals of Automobiles Sector.

Demand recovery is underway across segments, after experiencing multiple shocks such as demonetization, BS3 to BS4 transition, and GST, among others over the last 12 months.

"We do not expect any changes in indirect taxes. However, we expect higher allocation toward rural-focused schemes," Focus on rural markets could place the 2-wheeler industry back on the growth path.

This, coupled with the benefit of normal monsoon and 7th Pay Commission, could drive 2W.

Volume CAGR of 10-12 percent over FY17-19E. "Stocks which are likely to remain in focus include stocks like Hero MotoCorp, TVS Motor Company, M&M. Expects the introduction of a scrappage scheme, which would incentivize scrapping of trucks older than 10 years. This move would be positive for stocks like Ashok Leyland, and Bosch.

Recent sales number and the results were exciting for the industry and the outlook too is positive.

Outlook - Positive