Team24 Consumer Products Ltd enters into contract with Milk Union at Ambala

Team24 Consumer Products Ltd enters into contract with Milk Union at Ambala Alembic Pharmaceuticals Ltd receives 2 observations for Karakhadi Injectable Facility

Alembic Pharmaceuticals Ltd receives 2 observations for Karakhadi Injectable Facility RNIT AI Solutions Ltd receives pilot work order from Government of Meghalaya

RNIT AI Solutions Ltd receives pilot work order from Government of Meghalaya Dr. Reddy's forays into Hormone Replacement Therapy segment with acquisition of Progynova® and Cyclo- Progynova® in India

Dr. Reddy's forays into Hormone Replacement Therapy segment with acquisition of Progynova® and Cyclo- Progynova® in India HUL to invest up to ₹2,000 Crore in capacity expansion for Premium Categories

HUL to invest up to ₹2,000 Crore in capacity expansion for Premium Categories

Interesting Articles

To bet or not to bet on debt?

Posted On : 2018-03-23 22:28:35( TIMEZONE : IST )

By Duby Rex - @DubyRex

Debt, n. An ingenious substitute for the chain and whip of the slave driver - Ambrose Bierc.

It is well known that a debt free company gets a higher valuation than one with debt. Before we analyse about debt lets digress a little to discuss growth. All enterprises want to grow. We consider our business a successful one by its growth. Growth can be obtained in many ways. Let's analyse a few of them.

Conservative growth: The enterprise is churning out profits which are saved. The company uses the cash saved to increase capacity and drive growth. This has the least risk but the timeline could be a long one. The promoters are risk averse and sometimes could frustrate the investors.

Debt or equity led growth: The promoter has proved that her business model works by making profits on a sustainable basis. She wants to grow faster. She uses debt or equity to fuel her growth. Here the risk is based on the amount of debt taken. With larger debt comes greater risk. Delay in the execution of the huge capacity expansion could be a huge issue. The management plans with a time table of increasing capex and then paying off debt from the increased revenue. Larger the project larger the execution risk. Another risk is a sector or economy downturn wherein the increased production is not utilized. In both the cases if the debt costs are not serviced in time, the debt starts to pile up. The ending is most probably not very pleasant.

Venture funded growth: Before the business model is proved, promoters give huge equity to VC and scale the business in a grand manner. Here every month they keep burning cash on a hope that one day the business model will be proved right, and the returns will be spectacular. Here the risk is very high wherein most of the companies fail and the very few ones that are standing successfully become unicorns.

Which approach is right? There is no right or wrong, it entirely depends on the management to combat risk and of course the result. All the above 3 approaches are very difficult to implement. Think about yourself as a promoter running a business which is VC funded and making losses on a regular basis. The VCs are breathing down your neck and every day could be a battle. The conservative promoter also have their set of problems. If you are running a profitable business and trying to expand with the profits, it is going to take some time. In this era of instant gratification, your investors and well-wishers want you to grow faster. If you do not listen to them, you are branded as a fuddy duddy person.

The debt free companies and the VC funded companies form the edges of the bell curve. Most of the bell curve is occupied by companies that grow with debt. In the listed space too, rarely you can find companies with no or very less debt. When the debt is huge most of the risk averse investors stay away.

Pre-2008, many Indian companies which were doing well domestically acquired international companies. These transactions were predominantly funded by debt. When the financial crisis affected their foreign subsidiaries, it impacted their debt payment cycle and some of the companies are yet to recover from the same.

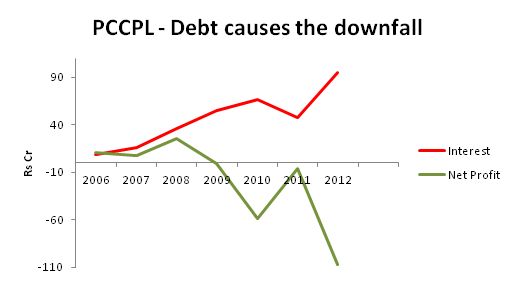

Punjab Chemicals & Crop Protection Limited (PCCPL) acquired Sintesis Quimica SAIC, Argentina & Agrichem BV. Netherlands in 2006 and 2007 respectively. The financial crisis hit the company very hard and in 2009 a major fire impacted its main factory. Nearly a decade after that, the company is still affected by the past events.

Another case study would be of Nitin Spinners. In 2007 it expanded capacity funded by debt, got hit by the 2008 crisis and went into CDR (Corporate Debt Restructuring). In 2014 Nitin Spinners exited CDR by compensating the lenders. It went for major expansion in 2015 using debt. In 2018 company has announced that it is setting up unit for manufacturing of apparel fabrics at a cost of Rs 650 Cr.

The lower value chain of the textile sector in India (like spinning) is mostly valued less compared to other segments / sectors. When the going gets good, these spinning units' capacity is utilized fully, and they need to enhance capacity to grow. This capex is funded by debt. With the margins being thin, any negative event like cotton pricing, export issue can cause their growth plans go haywire. So, the best-case scenarios are led by debt funded growth and the worst scenarios could even derail the existence of the company. Of course, there are few outliers in the spinning segment too.

Till now the debt we had talked about those ones used for driving growth. But there is debt used to run the business, the working capital or short-term debt. Majority of the companies take on debt to run the day to day operations of the organization. Just assume you are the CEO of a mid-sized firm and one fine day you inform your CFO that you are going to run the business without debt. What do you think would be the reaction of the CFO? Most probably he would burst a vein. It is very difficult to run a business without debt, we need to increase the payables, reduce the receivables and inventory. This is easier said than done.

Selling a product is only one part of the business, receiving the payment is more important. We can demand early receivables from the customers only if the product adds value to them. if our product is one among many chances are that the receivable days will be more. If the product is extremely in demand, customers may even pay in advance for the same.

Similarly extending the payment schedule is based on various factors. If the demand supply is in favour of the supplier, he will try to reduce the payable days. Building a relationship with the supplier, placing regular orders and paying in time would help here.

For keeping inventory low, proper supply chain management is needed. Again, the profile of the product would help.

All said and done, running a debt-free firm is very difficult. There are some exceptional companies which run the company and do capex without debt. The point in case would be Colgate Palmolive (India) Ltd.

Companies with debt will be valued less than those without debt. The reasons could be:

As an investor, should you prefer companies with debt or debt free ones? There is no right or wrong answer here. It depends on the risk-taking ability and the amount of effort spent to understand these companies.

If the investor risk averse or do not have much time to study/track the companies, it is better to choose debt free companies or companies with less debt. If the investor has a higher risk appetite and has the time to track, they could look at companies that are turning around. If you feel like gambling (high risk), then one could even have a go at the insolvency / bankruptcy cases.

Disclosure: The companies and stocks mentioned are for learning purpose only. Not by any imagination should they be construed as buy or sell call.